|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

|

Check the appropriate box:

| Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to § 240.14a-12 |

CapStar Financial Holdings, Inc.

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

|

|

March [●], 2020

Dear Shareholder,

I would like to extend a personal invitation for you to join us at the 2020 Annual Meeting of Shareholders which will be held on Friday, April 24, 2020, at 9:00 a.m. Central Time at the Tennessee Bankers Association located at 211 Athens Way #100, Nashville, Tennessee 37228.

Your attention is directed to the Notice of Annual Meeting of Shareholders and Proxy Statement enclosed with this letter which describe the formal business to be transacted at the meeting. Following the meeting, we will discuss the status of our business and answer appropriate questions.

Your vote is important. Please date, sign and promptly return the enclosed proxy card so that your shares may be voted in accordance with your wishes and so that the presence of a quorum may be assured. You may also vote by using the Internet or calling the toll-free number as further described in the enclosed proxy card. The giving of your proxy does not affect your right to revoke it later or to vote your shares in person if you decide to attend the meeting.

I hope that you will be able to attend the 2020 Annual Meeting of Shareholders. I look forward to seeing you.

| |

| |

| |

|

|

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

You are hereby invited to attendparticipate in the 20202021 Annual Meeting of Shareholders of CapStar Financial Holdings, Inc., which will be conducted virtually.

When |

| 9:00 |

|

|

|

|

|

In order to attend the Annual Meeting, you must register at www.proxydocs.com/CSTR. Upon completing your registration, you will receive further instructions via email, including a unique link that will allow you access to the Annual Meeting and to vote and submit questions during the Annual Meeting. Certain presentation materials that will be used at the 2021 Annual Meeting of Shareholders will be available on our website the day of the 2021 Annual Meeting of Shareholders under “News and Events.” |

|

| |

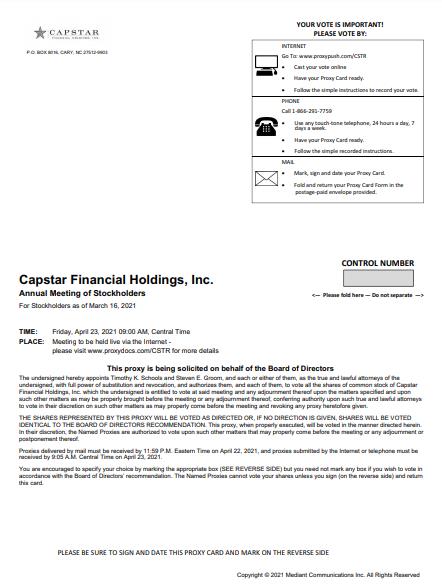

how to vote | To vote by the Internet, go to the website address set forth on the enclosed proxy card and follow the instructions provided on the website. To vote by telephone, dial the toll-free phone number set forth on the enclosed proxy card using a touch-tone phone. Have your proxy card available and follow the recorded instructions when voting by telephone. To vote by mail, complete, sign and date the proxy card and return it promptly in the postage paid envelope provided. Proxies delivered by mail, the Internet or telephone must be received prior to 9:00 A.M. Central Time on April 23, 2021.

| |

Record Date |

| Shareholders of record as of the close of business on March |

|

|

|

Items of Business |

| (1)To elect the following twelve (12) directors to serve until the

(2)To ratify the appointment of Elliott Davis, LLC as our independent registered public accounting firm for the fiscal year ending December 31,

(3)To approve

(4)To conduct such other business as may properly come before the meeting or any adjournment or postponement thereof. |

|

|

|

Recommendations |

| The Board of Directors recommends that you vote “FOR” each nominee for director in Proposal 1 and “FOR” each of Proposal 2 and Proposal 3. |

|

|

|

PROXY MATERIALS |

| Our proxy materials, which include this Proxy Statement, the proxy card and our Annual Report on Form 10-K for the year ended December 31, |

| By Order of the Board of Directors, | |

|

|

|

|

|

|

|

|

|

| Secretary |

|

March [●], 202026, 2021

Nashville, Tennessee

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Shareholders to be Held on April 24, 202023, 2021

This Proxy Statement and the Annual Report

are available at http://www.proxydocs.com/cstr

| Page |

1 | |

2 | |

5 | |

5 | |

5 | |

| |

| |

| |

| |

| |

| |

| |

| |

11 | |

12 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Policies and Procedures Regarding Related-Party Transactions |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

|

|

| |

| |

| |

Executive Compensation and Corporate Governance Enhancements | 23 |

| |

| |

| |

| |

| |

|

1201 Demonbreun Street, Suite 700

Nashville, Tennessee 37203

(615) 732-6400

PROXY STATEMENT FOR THE

20202021 ANNUAL MEETING OF SHAREHOLDERS

This Proxy Statement (this “Proxy Statement”) is furnished by CapStar Financial Holdings, Inc., a Tennessee corporation, on behalf of its Board of Directors (the “Board”) for use at the 20202021 Annual Meeting of Shareholders (the “Annual Meeting”), and at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Shareholders. This Proxy Statement and the accompanying proxy card are first being mailed or made available to shareholders on or about March [●], 2020.26, 2021. When used in this Proxy Statement, the terms “we,” “us,” “our” or the “Company” refer to CapStar Financial Holdings, Inc., and the “Bank” refers to CapStar Bank.

INFORMATION ABOUT THE ANNUAL MEETING

When is and where ishow do I participate in the Annual Meeting?

The Annual Meeting will be held at 9:00 a.m.A.M. Central Time on Friday, April 24, 202023, 2021. As a result of the coronavirus outbreak and to support the health and well-being of our partners, employees, and shareholders, the Annual Meeting will be held in a virtual-only meeting format, via live video webcast that will provide stockholders with the ability to participate in the Annual Meeting, vote their shares and ask questions. In order to attend the Annual Meeting, you must register at www.proxydocs.com/CSTR. Upon completing your registration, you will receive further instructions via email, including a unique link that will allow you access to the Annual Meeting and to vote and submit questions during the Annual Meeting. Certain presentation materials that will be used at the Tennessee Bankers Association which is located at 211 Athens Way #100, Nashville, Tennessee 37228.Annual Meeting will be available on our website the day of the Annual Meeting under “News and Events.”

What proposals will be voted upon at the Annual Meeting?

There are three proposals scheduled for a vote at the Annual Meeting:

| (1) | To elect the following twelve (12) directors to serve until the 2021 Annual Meeting of Shareholders and until their successors have been duly elected and qualified: Dennis C. Bottorff, L. Earl Bentz, |

| (2) | To ratify the appointment of Elliott Davis, LLC as our independent registered public accounting firm for the fiscal year ending December 31, |

| (3) | To approve |

| (4) | To conduct such other business as may properly come before the meeting or any adjournment or postponement thereof. |

As of the date of this Proxy Statement, we are not aware of any additional matters that will be presented for consideration at the Annual Meeting.

What are the recommendations of the Board of Directors?

Our Board recommends that you vote:

“FOR” the election of each of the twelve (12) nominees named herein to serve on the Board;

“FOR” the ratification of the appointment of Elliott Davis, LLC as our independent registered public accounting firm for the fiscal year ending December 31, 2020;2021; and

1

“FOR” the approval of the amendment to the Charter of CapStar Financial Holdings, Inc. 2021 Stock Incentive Plan.

Will our directors be in attendanceparticipate at the Annual Meeting?

It is the Company’s policy that all directors attend annual meetings of shareholders. Accordingly, weWe expect that all of our directors will be participating in attendance at the Annual Meeting.

Who is entitled to vote at the Annual Meeting?

Only shareholders of record at the close of business on the record date, March 19, 202016, 2021 (the “Record Date”), are entitled to receive notice of and to vote at the Annual Meeting or any adjournment or postponement thereof. As of the close of business on the Record Date, the Company had [●]22,078,293 shares of common stock outstanding.

How do I vote?

For Proposal 1 (election of directors), you may either vote “FOR” any of the nominees named herein to the Board or you may “WITHHOLD” your vote for any nominee that you specify. For Proposal 2 (ratification of the appointment of Elliott Davis, LLC) and Proposal 3 (approval of the amendment to the Charter of CapStar Financial Holdings, Inc. 2021 Stock Incentive Plan), you may vote “FOR” or “AGAINST” such proposal or “ABSTAIN” from voting. The procedures for voting are set forth below:

Shareholder of Record: Shares Registered Directly in Your Name. You may vote by completing, signing and dating the proxy card where indicated and mailing the proxy card in the postage paid envelope provided. You may also vote by giving your proxy authorization over the Internet or by telephone or by attendingusing the toll-free number on the proxy card until 9:05 A.M. Central Time on April 23, 2021, the time at which the polls are closed at the telephonic Annual Meeting and voting in person.Meeting. Whether or not you plan to attendparticipate in the telephonic Annual Meeting, we encourage you to vote by proxy or to give your proxy authorization to ensure that your votes are counted. You may still attend the Annual Meeting and vote in person ifIf you have already voted by proxy or given your proxy authorization.authorization, you may still participate in the telephonic Annual Meeting and vote using the Internet or by calling the toll-free number on the proxy card until the time the polls are closed at the Annual Meeting.

To vote by mail, complete, sign and date the proxy card and return it promptly in the postage paid envelope provided. If your signed proxy card is received by 11:59 P.M., Eastern Time on April 23, 2020, then we will vote your shares as you direct.

To vote by the Internet, go to the website address set forth on the enclosed proxy card and follow the instructions provided on the website.

To vote by telephone, dial the toll-free phone number listedset forth on yourthe enclosed proxy card using a touch-tone phonephone. Have your proxy card available and follow the recorded instructions.instructions when voting by telephone.

To vote in person, attend the Annual Meeting, and we will provide you with a ballot when you arrive.

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent. If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received the proxy materials from that organization rather than from the Company. As a beneficial owner, you have the right to direct your broker, bank, or other agent how to vote the shares in your account. You should follow the instructions provided by your broker, bank or other agent regarding how to vote your shares. To vote in person at the Annual Meeting, you must obtain a “legal proxy” from your broker, bank or other agent. To do this, contact your broker, bank or other agent and request a proxy card.

How many votes do I have?

For each proposal to be voted upon, you have one vote for each share of common stock that you own as of the close of business on the Record Date.

2

What if I return a proxy card but do not make specific choices?

Properly completed and returned proxies will be voted as instructed on the proxy card. If you are a shareholder of record and you return the signed and dated proxy card without marking any voting selections, your shares will be voted “FOR” the election of all twelve (12) director nominees named herein, “FOR” the ratification of the appointment of Elliott Davis, LLC as our independent registered public accounting firm for the fiscal year ending December 31, 2020,2021, and “FOR” the approval of the amendment to the Charter of CapStar Financial Holdings, Inc. 2021 Stock Incentive Plan. If any other matter is properly presented at the Annual Meeting, your proxy (one of the individuals named on your proxy card) will vote your shares as recommended by the Board or, if no recommendation is given, will vote your shares using his or her discretion. If any director nominee named herein becomes unavailable for election for any reason prior to the vote at the Annual Meeting, the Board may reduce the number of directors to be elected or substitute another person as nominee, in which case the proxy holders will vote for the substitute nominee.

If your shares are held by your broker, bank or other agent as your nominee, you will need to obtain a proxy card from the organization that holds your shares and follow the instructions included on that form regarding how to instruct your broker, bank or other agent to vote your shares. Brokers, banks or other agents that have not received voting instructions from their clients cannot vote on their clients’ behalf with respect to proposals that are not “routine” but may vote their clients’ shares on “routine” proposals. Under applicable state laws and the rules of the Nasdaq Global Select Market (“NASDAQ”), ProposalProposals 1 (election of directors) is aand 3 (approval of the CapStar Financial Holdings, Inc. 2021 Stock Incentive Plan) are “non-routine” proposal.proposals. Conversely, Proposal 2 (ratification of the appointment of Elliott Davis, LLC) and Proposal 3 (approval of amendment to Charter of CapStar Financial Holdings, Inc.) areis a “routine” proposals.proposal. If a broker, bank, or other agent indicates on a proxy card that it does not have discretionary authority to vote certain shares on ProposalProposals 1 aor 3, which are non-routine proposal,proposals, then those shares will be treated as broker non-votes for purposes of ProposalProposals 1 and 3, and such shares will not be counted as a “FOR” or “WITHHOLD” vote for purposes of Proposal 1. Conversely, brokers will have the discretionary authority to vote “FOR”, “AGAINST” or “ABSTAIN” on Proposal 2, and 3, if you do not instruct your broker otherwise. Although broker non-votes are counted as shares that are present at the Annual Meeting and entitled to vote for purposes of determining the presence of a quorum, they will not be counted as votes cast and will not have any effect on voting for the non-routine proposalproposals presented in this Proxy Statement.

Can I change my vote?

Yes. If you are the record holder of your shares, you may revoke your proxy in any of the following ways:

You may change your vote at any time before the proxy is exercised by re-submitting your vote via the Internet or by telephone;

You may submit another properly completed proxy card bearing a later date which is received by 11:59 P.M., Eastern Time on April 23, 2020;prior to the meeting date; or

You may send a written notice that you are revoking your proxy. The notice must be sent to 1201 Demonbreun Street, Suite 700, Nashville, Tennessee 37203, Attention: Corporate Secretary, and must be received by 11:59 P.M., Eastern Time on April 23, 2020; or22, 2021.

You may attend the Annual Meeting and notify the election officials that you wish to revoke your proxy and vote in person. However, your attendance at the Annual Meeting will not, by itself, revoke your proxy.

If your shares are held by your broker, bank or other agent as your nominee, you should follow the instructions provided by your broker, bank or other agent.

How many shares must be present to constitute a quorum for the Annual Meeting?

A quorum of shareholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares entitled to vote are represented (via proxy or telephonic participation) at the Annual Meeting. As of the close of business on the Record Date, there were [●]22,078,293 shares of voting common stock outstanding and entitled to vote. Thus, [●]11,259,929 shares of voting common stock must be represented (via proxy or virtual participation) at the Annual Meeting to have a quorum.

Your shares will be counted towards the quorum if you vote in personby submitting the enclosed proxy card by mail, or by submitting your vote via the Internet address or toll-free telephone number included on your proxy card prior to the time the polls are closed at the telephonic Annual Meeting, submit a valid proxy (or one is submitted on your behalf by your broker, bank or other agent) or give your proxy authorization over the Internet or by telephone. Additionally, “WITHHOLD” votes, abstentions and broker non-votes will also be counted towards the quorum requirement. If there is no quorum, the Chairman of the Annual Meeting may adjourn or postpone the meeting until a later date.

3

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting who will separately count (i) “FOR” and “WITHHOLD” votes and broker non-votes, if any, with respect to each of Proposal 1 (election of directors) and Proposal 3 (approval of the CapStar Financial Holdings, Inc. 2021 Stock Incentive Plan) and (ii) “FOR”, “AGAINST” and “ABSTAIN” votes with respect to each of Proposal 2 (ratification of the appointment of Elliott Davis, LLC) and Proposal 3 (approval of amendment to Charter of CapStar Financial Holdings, Inc.).

How many votes are needed to approve each proposal?

For Proposal 1 (election of directors), if a quorum is present, the vote ofdirector nominees will be elected by a plurality of all of the votes cast by the shares entitled to vote in the election at the Annual Meeting is necessary for the election of a director.Meeting. Shareholders are not entitled to cumulative voting in the election of our directors. For purposes of the election of directors, “WITHHOLD” votes and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote.

For each of Proposal 2 (ratification of the appointment of Elliott Davis, LLC) and Proposal 3 (approval(approval of amendment to Charter ofthe CapStar Financial Holdings, Inc. 2021 Stock Incentive Plan), if a quorum is present, the Proposals will be approved if the votes cast for the proposal exceed the votes cast against the proposal. Abstentions and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote.

How can I determine the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Within four business days after the conclusion of the Annual Meeting, the Company will file a Current Report on Form 8-K with the Securities and Exchange Commission (“SEC”) that announces the final voting results.

Who can help answer any questions I may have?

Shareholders who have questions about the matters to be voted on at the Annual Meeting or how to submit a proxy or who desire additional copies of this Proxy Statement or additional proxy cards should contact our Investor Relations department via (i) mail at CapStar Financial Holdings, Inc., 1201 Demonbreun Street, Suite 700, Nashville, Tennessee 37203, Attention: Investor Relations, (ii) email at ir@capstarbank.com or (iii) telephone at (615) 732-6455.

4

PROPOSAL 1

Our Charter and Amended and Restated Bylaws (“Bylaws”) provide that our Board will consist of between five and 25 directors, with the precise number being determined by our Board from time to time. The size of our current Board is thirteen (13), however, with the resignation of Mr. Thornburgh effective December 15, 2019, we currently have twelve (12) directors serving on our Board.fourteen (14).

In accordance with our Bylaws and Tennessee law, our Board oversees the management of the business and affairs of the Company. Our directors are elected annually by our shareholders at our annual meetings of shareholders for one-year terms and serve until their successors are duly elected and qualified or until their earlier death, resignation, retirement or removal. Our Board also serves as the Board of our wholly-owned bank subsidiary, CapStar Bank.

At the Annual Meeting, twelve (12) persons will be electedDirectors are being recommended for election to serve on our Board until the 20212022 Annual Meeting of Shareholders and until their successors have been duly elected and qualified or until such director’s earlier resignation or removal. Mrs. Frist hasMr. Dale W. Polley and Mr. Jeffrey L. Cunningham have informed us that she isthey are not standing for re-election to our Board at the Annual Meeting. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee named herein will be unable to serve. There are no family relationships among any of the members of our Board.

Mrs. Julie D. Frist, Vice Chair of our Board and Chair of our Nominating, Governance and Community Affairs Committee will not be standing for reelection at the Annual Meeting. Our Nominating Governance and Community AffairsCorporate Governance Committee has nominated Joelle J. PhillipsSam B. DeVane and Valora S. Gurganious to stand for election at the Annual Meeting. Accordingly, afterupon the Annual Meeting, we expect thatelection of the sizerecommended slate of our Board will be thirteen (13) but that weDirectors, the Company will have twelve (12) directorsDirectors sitting on our Board.

In connection with the previously announced proposed mergersits Board of FCB Corporation, a Tennessee corporation (“FCB”), The First National Bank of Manchester, a national banking association and wholly owned bank subsidiary of FCB (“FNBM”), and The Bank of Waynesboro, a Tennessee chartered bank and affiliate of FCB (“BOW”), with and into the Company and CapStar Bank, as applicable (the “Mergers”), one member of the current board of directors of FCB, FNBM or BOW will be selected by FCB in consultation with the Company and appointed as the thirteenth (13th) member of the Company’s Board at the effective time of the Mergers, which will fill the vacancy remaining on the Board after the Annual Meeting. Shareholders will not be entitled to vote at the Annual Meeting for the director who will fill the vacancy on the Board in connection with the Mergers.Directors.

Set forth below is the background and qualifications of each director nominee.

Dennis C. Bottorff—Chairman of the Board of Directors

Mr. Bottorff, age 75,76, was one of the founders of CapStar Bank and currently serves as Chairman of our Board and as a member of the Nominating Governance and Community AffairsCorporate Governance Committee and the CreditCompensation and Human Resources Committee. Mr. Bottorff has served on our Board since 2008. He is also the Founding General Partner of Council Capital Management, a private equity firm located in Nashville, where he was previously a Managing Partner from 2001 to 2016. Mr. Bottorff began his career in banking in 1968 at the former Commerce Union Bank in Nashville. After serving in numerous positions, he was named President in 1981 and Chief Executive Officer shortly thereafter. When Commerce Union Bank merged with Sovran Financial Corporation, or Sovran, in 1987, Mr. Bottorff became Chief Operating Officer of Sovran and moved to Norfolk, Virginia. He continued in this position when Sovran merged with Citizens and Southern Bank in Atlanta. After Citizens and Southern Bank and Atlanta to form C&S/Sovran. In 1991 C&S/Sovran merged with NCNB Corporation to form NationsBank,NationsBank. Mr. Bottorff returned to Nashville in 1991 to become Chief Executive Officer of First American National Bank.Corporation. Following AmSouth’s acquisition of First American National BankCorporation in 1999, Mr. Bottorff served as AmSouth’s Chairman of the board until his retirement in January 2001. He has served on over twelve corporate boards, including all of the banks at which he was an officer, Dollar General, Shoney’s, Ingram Industries and Tennessee Valley Authority, where he served as Chairman. Presently, he is Trustee Emeritus at Vanderbilt University and a director of ANS, LLC.University. His

leadership in the community has included serving as Chairman of the Tennessee Education Lottery Corporation, the United Way, the Nashville Symphony, the Nashville Area Chamber of Commerce, the Titans Advisory Board, and the Tennessee Performing Arts Center. He received a B.E. degree in electrical engineering from Vanderbilt University and an M.B.A. from Northwestern University. We believe Mr. Bottorff’s extensive leadership and governance experience at regional banks, in private equity and on corporate and non-profit boards gives him valuable insight and enables him to make significant contributions as a member of our Board.

5

L. Earl Bentz—Director

Mr. Bentz, age 68,69, was one of the founders of CapStar Bank and currently serves on the Audit and Risk Committee and the Credit Committee. Mr. Bentz has served on our Board since 2008. Since 1996, he has been President and Chief Executive Officer of Triton Boats, a company he sold to Brunswick Corporation in 2005. Mr. Bentz serves on the board of directors of the Country Music Hall of Fame, and he has formerly served on the boards of the Middle Tennessee Council, Boy Scouts of America, the Tennessee Wildlife Resources Foundation, the National Association of Boat Manufacturers, the National Marine Manufacturers’ Association, the Recreational Boating and Fishing Foundation and the Congressional Sportsman’s Foundation. Mr. Bentz attended Clemson University and participated in continuing education programs in business finance at Vanderbilt University; he has also completed the Dale Carnegie Human Relations courses and training. Mr. Bentz’s business background, which also includes extensive experience in commercial real estate development and start-up companies, gives him valuable insight and enables him to make significant contributions as a member of our Board.

Jeffrey L. Cunningham—Sam B. DeVane—Director and Nominee for Vice Chair of the Board of Directors

Mr. Cunningham,DeVane, age 62, has extensive experience in community banking61, serves on the Audit and recently served as an Executive Vice President of CapStar Bank until his retirement in December 2019.Risk Committee and the Compensation and Human Resources Committee. Mr. CunninghamDeVane has served on our Board since his appointment on October 24, 2018, and currently serves onJanuary 14, 2021. With more than three decades of public accounting experience serving clients throughout the Risk Committee and the Credit Committee. Previously,southeast, Mr. CunninghamDeVane retired as Nashville Office Managing Partner of Ernst & Young LLP. He previously served as PresidentEY’s Tennessee Markets Leader, and CEOas a coordinating partner and lead audit partner for over twenty years. The majority of Athens Federal Community Bank from MarchMr. DeVane’s career involved service to clients in the retail and consumer products sector along with numerous manufacturers, distributors, and retailers, including Dollar General Corporation, Tractor Supply Company and Ryman Hospitality Corporation. He brings extensive technical accounting, corporate governance, major transactions, strategy, process automation, financial reporting, and risk management experience. A licensed CPA in Tennessee, Mr. DeVane is a member of 2000 through September 30, 2018 when Athens Federal Community Bank merged with CapStar Bank. Mr. Cunningham served as Chairmanthe American Institute of Southland Finance Company,Certified Public Accountants and Tennessee Society of Certified Public Accountants. He earned a subsidiaryBachelor of Athens Federal Community Bank. Mr. Cunningham was the lead officer and director of Athens Federal Community Bank in its conversion from a mutual savings bank to an OCC chartered Savings Bank and IPO in 2010 and later its conversion to an OCC chartered National Bank. Prior to entering the banking profession in 2000, Mr. Cunningham practiced law for 12 years with an emphasis on commercial transactions, personal and commercial litigation, probate, and real estate law. Mr. Cunningham is an AV rated lawyer. Mr. Cunningham received a B.S. in Banking and FinanceScience degree from the University of Alabama. Mr. DeVane has served on several distinguished professional boards, including United Way of Middle Tennessee at Knoxville(Chair of the Nashville Campaign), Junior Achievement (Centennial Leadership Award recipient), Harding Academy (Treasurer), and is an honors graduate of the University of Tennessee College of Law. Mr. Cunningham is a graduate of the ABA Graduate School of Banking held at Georgetown University. Mr. Cunningham is past President of the Independent Bankers Division of the Tennessee Bankers Association. He served two terms as president of the McMinn Bar Association. Mr. Cunningham also serves as PresidentAlabama President’s Cabinet and CEO of the Athens Federal Foundation which is active throughout Southeast Tennessee financing and funding various charitable causes and organizations which are active in addressing the basic human needs of food, shelter, clothing, safety, and security.Accounting Advisory Board. We believe Mr. Cunningham’s extensive backgroundDeVane’s business experience and involvement in banking and his legal knowledgethe community give him valuable insight and allowsenable him to make significant contributions as a member of our Board.

Thomas R. Flynn—Director

Mr. Flynn, age 47,48, serves as Chair of the AuditCompensation and Human Resources Committee and also serves on the CompensationAudit and Human ResourcesRisk Committee. Mr. Flynn has served on our Board since 2008. Mr. Flynn is a director of Flynn Enterprises, LLC, a family owned, multi-national garment manufacturing, sales and distribution company headquartered in Hopkinsville, Kentucky, and serves on the boards of Planters Bank, Hopkinsville, for which he is also a member of the audit committee,Audit and Risk Committee, and Jennie Stuart Medical Center, a regional hospital that serves Western Kentucky. Mr. Flynn attended Vanderbilt University as a National Merit Scholar, graduating with a bachelor’s degree in English, and subsequently received a law degree from Vanderbilt University Law School. We believe Mr. Flynn’s leadership in manufacturing and experience as a director in banking, healthcare and manufacturing and legal knowledge give him valuable insight and enables him to make significant contributions as a member of our Board.

Mr. Green, age 66,67, serves on the Audit and Risk Committee and the Nominating, Governance and Community AffairsCredit Committee and chairs our Advisory Board for Sumner County, which provides guidance to our management regarding that portion of our market. Mr. Green has served on our Board since 2012. He was an incorporator of American Security, which merged with CapStar in July 2012. Mr. Green is General Partner of Green & Little, a real estate investment company, and President of Green-Little Corporation, a real estate management company. He holds partnership interests in several companies investing in industrial, commercial and retail real estate. Mr. Green has served as director of Commerce Union Bank of Sumner County and as an advisory director of NationsBank. He attended the University of Tennessee. We believe Mr. Green’s extensive experience in banking and real estate gives him valuable insight and enables him to make significant contributions as a member of our Board.

Valora S. Gurganious—Director

Ms. Gurganious, age 57, serves on the Community Affairs Committee and the Nominating and Corporate Governance Committee. Ms. Gurganious has served on our Board since her appointment on January 14, 2021. Ms. Gurganious serves as Partner and Senior Management Consultant for Knoxville-based DoctorsManagement, LLC, assisting clients in all medical specialties and providing services related to operational efficiency, workflow optimization, compliance, IT, accounting, marketing, and strategic planning. She also advises physicians and hospitals across the country on practice valuation, startup, contract negotiation and transition of ownership. Prior to joining DoctorsManagement, Ms. Gurganious served as Chief Operating Officer for Central Florida Sports Medicine and

6

Orthopedic Center in Melbourne, and as Director and Vice Chair – Finance for Wuesthoff Foundation, a $10 million Florida health system foundation. She also held the position of senior vice president with Fleet Investment Advisors and Putnam Investments in Boston for seven years and is a licensed Business Broker in the state of Florida. Ms. Gurganious earned a Bachelor of Arts degree in economics and business administration from Vanderbilt University and MBA from Harvard Business School. She is a Certified Healthcare Business Consultant and a member of the National Society of Certified Healthcare Business Consultants (NSCHBC) as well as Executive Women International (EWI). A dynamic and accomplished speaker, Ms. Gurganious uses her expertise to deliver strategic healthcare and financial lectures at medical conferences across the country. We believe Ms. Gurganious’s business experience and involvement in the community give her valuable insight and enable her to make significant contributions as a member of our Board.

Myra NanDora Jenne—Director

Ms. Jenne, age 51,52, serves as Chair of the Community Affairs Committee and also serves on the Compensation and Human Resources Committee and the Nominating, Governance and Community Affairs Committee. Ms. Jenne has served on our Board since her appointment on October 24, 2018. She graduated with Honors with a B.S. from the University of Tennessee at Knoxville, where she served as captain of the Tennessee Dance Team. She went on to attend Samford University’s Cumberland School of Law and graduated with a J.D. in 1994. Ms. Jenne began practicing law with Carter, Harrod & Cunningham in Athens, Tennessee, and later practiced in Knoxville with Leitner, Williams, Dooley & Napolitan. She currently practices at The Jenne Law Firm in Cleveland, Tennessee, and also serves as the firm’s office manager. Ms. Jenne has served on the board of directors of Athens Federal Community Bank and on the Nalls Sherbakoff Group financial advisory board in Knoxville, Tennessee. She has been involved in various civic and charitable organizations in Cleveland, Tennessee over the past twenty years including serving on the boards at the Museum Center at Five Points and the Cleveland Athens Cotillion. She has also served on the Board of Trustees at Broad Street United Methodist Church and serves on several committees at The Baylor School in Chattanooga, Tennessee. We believe Ms. Jenne’s extensive leadership experience and professional experience give her valuable insight and enables her to make significant contributions as a member of our Board.

Joelle J. Phillips—Director

Ms. Phillips, age 53, has been nominated by54, serves on the Nominating and Corporate Governance Committee and the Community Affairs Committee to stand for election as a member of our Board.Committee. Ms. Phillips graduated magna cum laude with a B.F.A. from Birmingham-Southern College in 1989 and went on to attend Washington & Lee University, School of Law where she graduated summa cum laude with a J.D. in 1995. Ms. Phillips began practicing law as law clerk for Hon. Rhesa H. Barksdale of the U.S. Court of Appeals for the Fifth Circuit, and later practiced in Atlanta, Georgia with Long, Aldridge & Norman LLP and in Nashville with Waller Lansden Dortch & Davis, LLP. After serving as General Attorney for both BellSouth and AT&T Tennessee, she now serves as the President of AT&T Tennessee, a position she has held since 2013. Ms. Phillips is involved in several civic and charitable organizations in Nashville, Tennessee, including serving as the Chair for the Drive to 55 Coalition and serving on the boards of Birmingham-Southern College, Tennessee Business Leadership Coalition and Nashville Repertory Theatre. Furthermore, Ms. Phillips was recognized as the Nashville Business Journal Newsmaker of the Year for 2015, Nashville’s Power 100 list, Nashville’s Women Business Leaders of the Year 2014, Tennessee Board of Regents’ Award for Philanthropy and was named one of Nashville’s Outstanding CEOs for 2017. We believe that Ms. Phillips’ professional experience combined with her long history of involvement in the Nashville community will allow her to make significant contributions as a member of our Board.

Dale W. Polley—Vice Chair of the Board of Directors

Mr. Polley, age 70, serves as Chair of the Risk Committee and also serves on the Audit Committee. Mr. Polley has served on our Board since 2011. He has extensive experience within the financial services industry, having most recently served as Vice Chairman and President of First American Corporation. Before joining First American National Bank in 1991, Mr. Polley was Group Executive Vice President and Treasurer for C&S/Sovran Corporation after holding various executive positions within Sovran before its merger with Citizens and Southern Bank. Mr. Polley joined Sovran from Commerce Union Bank of Nashville, where he was Executive Vice President and Chief Financial Officer. Mr. Polley retired as a Vice Chairman and member of the board of directors of First American Corporation and First American National Bank in 2000. Mr. Polley is a member of Leadership Nashville, the Financial Executives Institute and the Tennessee Society of Certified Public Accountants. He recently served as a member of the board of

directors and audit committee of HealthStream, Inc., and is currently a member of the board of the Franklin American Music City Bowl. He has also served on the board, including the audit and executive committees, of Pinnacle Financial Partners, the board, including the audit committee, of O’Charley’s Inc., and the board of the Nashville branch of the Federal Reserve Bank of Atlanta. Mr. Polley received a bachelor’s degree from the University of Memphis. We believe his long career in leadership positions at regional banks and experience as a director of public companies, including chairing several audit committees, gives him valuable insight and enables him to make significant contributions as a member of our Board.

Timothy K. Schools—Director, President and Chief Executive Officer of CapStar Financial Holdings, Inc. and CapStar Bank

Mr. Schools, age 50,51, has served as a Director and the President and Chief Executive Officer of the Company since July 2019.2019 and is a member of the Tennessee Business Roundtable. Mr. Schools most recently served as a Director and the President and Chief Executive Officer at Highlands Bankshares. In Abingdon, Virginia.Bankshares, Inc. At Highlands, he led the Board of Directors and Executive Committee in establishing and executing a strategic plan, following a private equity recapitalization. During his tenure, Highlands significantly improved its financial performance, achievedrecapitalization, which led to “Best Bank” designations in each of their markets, and remediatedremediation of a long-standing and preexisting regulatory Written Agreement.Agreement, and materially improved financial performance. Prior to his tenure with Highlands, Mr. Schools served as Chief Strategy Officer of United Community Bank in Greenville, South Carolina and President of American Savings Bank in Honolulu, Hawaii.Bank. He joined United Community Bank as a member of its Executive Committee, following a private equity recapitalization. During Mr. Schools’ tenure, United Community Bank restored its financial health, achievedrecapitalization and as part of the Executive Committee led the company to national customer service recognition, and remediated a preexisting regulatory Memorandum of Understanding.Understanding, and restored financial health. At American Savings Bank, Mr. Schools served as President and led the Board of Directors and Executive Committee in developing and executing a strategic plan designed to earn and achieve independence. The planwhich resulted in a material improvement in financial performance,increased market competitiveness, the creation of a market and industry leading culture, elevated competitiveness among its peers, and remediation of a preexisting regulatory Cease and Desist order.order, and substantial improvement in financial performance. Mr. Schools previously served as Chief Financial Officer of The South Financial Group where he was recognized nationally by Institutional Investor and has served as a board member of APCO Employees Credit Union, First Market Bank, CRA Partners, Nasdaq Issuer Advisory Council, and OTC Markets Group Issuer Advisory Council. Mr. Schools graduated magna cum laude from James Madison University with a Bachelor’s degree in business administration and received his M.B.A from Emory University. We believe Mr. Schools’ extensive experience in the banking industry coupled with leadership roles on private and non-profit boards give him valuable insight and enable him to make significant contributions as a member of our Board.

7

Stephen B. Smith—Director

Mr. Smith, age 66,67, serves on the Credit Committee and the Nominating, Governance and Community Affairs Committee. Mr. Smith has served on our Board since 2008. He is Chairman of Haury & Smith Contractors, Inc., a building and development company. He is active in the community, having served on the Metropolitan Nashville Planning Commission and the Regional Transit Authority and as Chairman of the Metropolitan Nashville Parks and Recreation board of directors. Mr. Smith served as National Finance Co-Chair for Senator Lamar Alexander’s presidential campaigns in 1996 and 2000, and he achieved Super Ranger status in President George W. Bush’s 2004 campaign. He was National Finance Chairman for Senate Majority Leader Bill Frist’s leadership political action committee, VOLPAC, served as Finance Chairman for Senator Lamar Alexander’s 2008 and 2014 re-election campaigns, and is currently the Finance Chairman for Senator Alexander’s leadership political action committee, TENNPAC. In addition he has served on the boards of the FHLB and Franklin Road Academy, and as director of the First Union National Bank community board. He holds a bachelor’s degree from Middle Tennessee State University. He serves as Chairman of the Board of Trustees of Middle Tennessee State University, where he received his bachelor’s degree. We believe Mr. Smith’s business experience, banking board service and involvement in the community give him valuable insight and enable him to make significant contributions as a member of our Board.

Mr. Turner, age 49,50, was one of the founders of CapStar Bank and serves as Chair of the Credit Committee and also serves on the RiskCommunity Affairs Committee. Mr. Turner has served on our Board since 2008. He joined Marketstreet Enterprises in 1999 and has served as the Managing Director since 2007. Mr. Turner hasHe serves on the boards of the Country Music Hall of Fame and the Nashville Downtown Partnership. He also had previously been a member of the board of directors of the Farmers National Bank Financial Corporation in Scottsville, Kentucky, for more than 15 years. He also serves on the boards of Cumberland Heights, the Nashville Downtown Partnership Board and the Frist Center for the Visual Arts. He received his bachelor’s degree from Vanderbilt University and his law degree from Vanderbilt University Law School. We believe Mr. Turner’s experience in and knowledge of the commercial real estate industry, his community banking board service, as well as his investment and legal knowledge, give him significant insight and enable him to make significant contributions as a member of our Board.

Toby S. Wilt—Director

Mr. Wilt, age 75,76, was one of the founders of CapStar Bank and serves as Chair of the Nominating and Corporate Governance Committee and also serves on the Compensation and Human Resources Committee and member of the Audit Committee. He has served on our Board since 2008. Mr. Wilt has nearly four decades of experience in the banking industry. Mr. Wilt is a retired, non-practicing certified public accountant, who is no longer affiliated with the Tennessee Association of Accountants or the AICPA. He practiced accountancy with Ernst & Ernst in the 1970s. He has previously served on the boards of directors of banks and public companies including C&S/Sovran Corporation, Commerce Union Bank, Outback Steakhouse and Genesco Inc. Mr. Wilt currently serves as President of TSW Investment Company, Founding President of Golf Club of Tennessee, and Chairman of the board of Christie Cookie Company. Mr. Wilt is also a former board member of First American National Bank.Corporation. He earned a B.E. in civil engineering from Vanderbilt University and is a former pilot in the United States Air Force. We believe Mr. Wilt’s significant experience in banking and as a director of banks and public companies, including his service on audit and human resource committees, gives him valuable insight and enables him to make significant contributions as a member of our Board.

If a quorum is present, the director nominees will be elected by a plurality of the votes cast by the shares entitled to vote in the election at the Annual Meeting, each nominee will be approved if the votes cast for such nominee exceed the votes cast against such nominee. If a nominee is not approved, the matter will be referred to the Nominating, Governance and Community Affairs Committee for further review.Meeting.

THE BOARD RECOMMENDS A VOTE “FOR” EACH NOMINEE NAMED ABOVE.

8

We are committed to having sound corporate governance principles, which are essential to running our business efficiently and maintaining our integrity in the marketplace. We understand that corporate governance practices change and evolve over time, and we seek to adopt and use practices that we believe will be of value to our shareholders and will positively aid in the governance of the Company. To that end, we regularly review our corporate governance policies and practices and compare them to the practices of other peer public companies. We will continue to monitor emerging developments in corporate governance and enhance our policies and procedures when required or when our Board determines that it would benefit us and our shareholders.

In this section, we describe the roles and responsibilities of our Board and its committees and describe our corporate governance policies, procedures and related-documents. All of our Board’ committees have written charters, which can be found on our Investor Relations webpage under the tab entitled “Corporate Governance - Documents & Charters” at www.ir.capstarbank.com. We will also provide a copy of any committee charter, our Corporate Governance Guidelines and our Code of Ethics and Conflicts of Interest Policy without charge upon written request sent to 1201 Demonbreun Street, Suite 700, Nashville, Tennessee 37203, Attention: Investor Relations. Information that is presented or hyperlinked on our website is not incorporated by reference into this Proxy Statement.

NASDAQ rules require that independent directors comprise a majority of our Board. In addition, NASDAQ rules, as well as those of the SEC, impose several other requirements with respect to the independence of our directors. Accordingly, our Board has evaluated the independence of its members based upon the rules of NASDAQ and the SEC. Applying these standards, our Board has affirmatively determined that, with the exception of Mr. Schools, and Mr. Cunningham, each of our current directors is an independent director, as defined under the applicable rules. Our Board determined that Mr. Schools does not qualify as an independent director because he is an executive officer of the Company and that Mr. Cunningham does not qualify as an independent director because he was an employee of the Company within the last three years.Company.

The Board meets at least quarterly at regularly scheduled meetings. Directors are expected to attend and participate in all meetings, including the Company’s annual meetingsmeeting of shareholders, and must be willing to devote sufficient time, energy and attention to properly discharging their duties and responsibilities to the Company and the Board effectively twelve (12)effectively. All of our thirteen (13) directors then serving on the Board attended the 20192020 Annual Meeting of Shareholders. We expect all of our directors to attend at least 75% of the total of all meetings of the Board and the committees on which he or she serves during a fiscal year. When considering nominees for re-election to the Board, the Nominating Governance and Community AffairsCorporate Governance Committee may consider exceptions to our attendance policy for excusable absences.

Independent directors meet in executive session at each Board meeting, with no members of management and only independent directors being present. Mr. Bottorff, the Chairman of the Board, presides at all executive sessions of independent directors.

During 2019,2020, the Board met on ten (10)thirteen (13) occasions, including two (2)five (5) specially called meetings of the Board. In 2019,2020, each director attended at least 75% of the total of all meetings of the Board and the committees on which he or she served during the period in which he or she served on our Board or the respective committee of our Board.

Our Board has the authority to appoint committees to perform certain management and administrative functions. During 2019,2020, our Board had five committees: the Audit and Risk Committee, the Nominating and Corporate Governance andCommittee, the Community Affairs Committee, the Compensation and Human Resources Committee the Credit Committee and the RiskCredit Committee. These committees of our Board also performed the same functions for the Bank. Our Board adopted written charters for each of these committees. As necessary, from time to time, special committees may be established by our Board to address certain issues. The following table shows the composition of each of the committees of our Board during 20192020 and the number of times each committee met during 2019:

2020:

Name |

| Audit |

| Nominating, Governance and Community Affairs |

| Compensation and Human Resources |

| Credit |

| Risk |

| Audit (1) |

| Risk (1) |

| Audit and Risk (1) |

| Nominating, Governance and Community Affairs (2) |

| Nominating and Corporate Governance (2) |

| Community Affairs (2) |

| Compensation and Human Resources |

| Credit |

Dennis C. Bottorff |

|

|

| X |

|

|

| X |

|

|

|

|

|

|

|

|

| X |

| X |

|

|

| X |

| X |

L. Earl Bentz |

| X |

|

|

|

|

| X |

|

|

| X |

| X |

| X |

|

|

|

|

|

|

|

|

| X |

Jeffrey L. Cunningham |

|

|

|

|

|

|

| X |

| X |

|

|

| X |

| X |

|

|

|

|

| X |

|

|

|

|

Thomas R. Flynn |

| X* |

|

|

| X |

|

|

|

|

| X* |

|

|

| X |

|

|

|

|

|

|

| X* |

| X |

Julie D. Frist |

|

|

| X* |

| X |

|

|

|

|

|

|

|

|

|

|

| X* |

|

|

|

|

| X |

|

|

Louis A. Green III |

| X |

| X |

|

|

|

|

|

|

| X |

|

|

| X |

| X |

|

|

|

|

|

|

| X |

Myra NanDora Jenne |

|

|

| X |

| X |

|

|

|

|

|

|

|

|

|

|

| X |

| X |

| X* |

| X |

|

|

Joelle J. Phillips |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| X |

| X |

|

|

|

|

Dale W. Polley |

| X |

|

|

|

|

|

|

| X* |

| X |

| X* |

| X* |

| X |

| X |

|

|

|

|

|

|

Timothy K. Schools |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen B. Smith |

|

|

| X |

|

|

| X |

|

|

|

|

|

|

|

|

| X |

|

|

| X |

|

|

| X |

Richard E. Thornburgh (4) |

|

|

|

|

| X |

|

|

| X | ||||||||||||||||

James S. Turner, Jr. |

|

|

|

|

|

|

| X* |

| X |

|

|

| X |

|

|

|

|

|

|

| X |

|

|

| X* |

Toby S. Wilt |

| X |

|

|

| X* |

|

|

|

|

| X |

|

|

|

|

|

|

| X* |

|

|

| X |

|

|

Number of Meetings in 2019 |

| 13 |

| 6 |

| 5 |

| 9 |

| 9 | ||||||||||||||||

Number of Meetings in 2020 |

| 5 |

| 3 |

| 6 |

| 3 |

| 5 |

| 2 |

| 5 |

| 8 | ||||||||||

* | Committee Chair |

(1) | Effective April 24, 2020, the Audit Committee and Risk Committee were combined to create one committee – the Audit and Risk Committee. |

(2) | Effective April 24, 2020, the Nominating, Governance and Community Affairs Committee was split into two committees – the Nominating and Corporate Governance Committee and the Community Affairs Committee. |

(3) | Although Mrs. Frist served during |

|

|

| Mr. Schools became a member of our Board effective July 31, 2019. Mr. Schools does not currently serve on any of the committees of our Board. |

|

|

The table above and the following disclosure provides detail regarding the composition and responsibilities of each of the Board’s committees during the year ended December 31, 2019.2020. On March 5, 2020, our Board approved the consolidation of our Audit Committee with our Risk Committee and certain committee reassignments, to bewhich was effective upon the election of director nominees at the 2020 Annual Meeting. For more information regarding these changes, please see “Corporate Governance — 2020 Committee Reassignments and Combining of Audit and Risk Committees.”

Our Audit and Risk Committee consists of Messrs. FlynnPolley (Committee Chair), Bentz, Green, PolleyFlynn and Wilt.Green. Mr. DeVane began serving on the Audit and Risk Committee upon being appointed to the Board on January 14, 2021. Our Audit and Risk Committee charter requires that our Audit and Risk Committee be comprised entirely of independent directors. The committee is responsible for, among other things: monitoring the integrity of, and assessing the adequacy of, our financial statements, the financial reporting process and our system of internal accounting and financial controls; assisting our

Board in ensuring compliance with laws, regulations, policies and procedures; selecting our independent registered public accounting firm and assessing its qualifications, independence and performance; monitoring the internal audit function; reviewing and, if appropriate, pre-approving all auditing and permissible non-audit services performed by the independent registered public accounting firm; and reviewing and, if appropriate, approving related-party transactions other than those subject to Regulation O. At least once per year, our Audit and Risk Committee meets privately with each of our independent registered public accounting firm, management and our internal auditors.

Furthermore, this committee is responsible for, among other things, assisting our Board in its oversight of our enterprise risk management governance and processes and for reviewing and approving the risk parameters to be used by management in the operation

10

of the Company. Additionally, its roles include capital management oversight; providing oversight of asset liability management processes; reviewing our insurance risk management program; ensuring that our internal policies, procedures and guidelines are appropriate to manage risk; monitoring interest rate risk management; and approving our asset/liability and investment policies.

Our Board has affirmatively determined that each of Messrs. Polley, Bentz, DeVane, Flynn Bentz,and Green Polley and Wilt satisfies the requirements for independence as an audit committee member under the Sarbanes-Oxley Act (“SOX”) and the rules and regulations of NASDAQ and the SEC. Further, the Board has determined that each of Messrs. Polley, Bentz, DeVane, Flynn Bentz,and Green Polley and Wilt satisfies the requirements for financial literacy under the rules and regulations of NASDAQ and the SEC, and that each of Messrs. Polley, Bentz, DeVane, Flynn Green, Polley and WiltGreen qualify as an “audit committee financial expert” as defined in the SEC rules and satisfies the financial sophistication requirements of NASDAQ.

Compensation and Human Resources Committee

Our Compensation and Human Resources Committee consists of Mr. WiltFlynn (Committee Chair), Mr. Flynn, Mrs. FristBottorff, Ms. Jenne and Ms. Jenne. Mrs. Frist is not standing for re-election at the Annual Meeting and, therefore, will not serve as a member ofMr. Wilt. Mr. DeVane began serving on the Compensation and Human Resources Committee afterupon being appointed to the Annual Meeting.Board on January 14, 2021. Our Compensation and Human Resources Committee charter requires that our Compensation and Human Resources Committee be comprised entirely of independent directors. The committee is responsible for, among other things, reviewing and approving compensation arrangements with our Chief Executive Officer and other executive officers; advising management with respect to compensation, including equity and non-equity incentives; making recommendations to the Board regarding our overall equity-based incentive programs; administering a performance review process for, and, in collaboration with the Nominating Governance and Community AffairsCorporate Governance Committee; and, in collaboration with the Nominating Governance and Community AffairsCorporate Governance Committee, periodically reviewing the succession plan for the Chief Executive Officer and other executive officers. In addition, the committee annually reviews corporate goals and objectives relevant to the compensation of our Chief Executive Officer and other executive officers and recommends compensation levels to the Board based on this evaluation. See “Executive Compensation – Narrative Discussion of Summary Compensation Table – Compensation Philosophy” for more information.

Our Board has determined that each member of our Compensation and Human Resources Committee meets the requirements for independence under the rules and regulations of NASDAQ and the SEC, qualifies as an “outside director” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended, (the “Code”), and as a “non-employee director” for purposes of Rule 16b‑3 of the Exchange Act. Our board has determined that each of Mr. Wilt,Flynn, Mr. Flynn, Mrs. FristBottorff, Mr. DeVane, Ms. Jenne and Ms. JenneMr. Wilt are independent; thus, a majority of the directors serving on our Compensation and Human Resources Committee are independent as required by the Compensation and Human Resources Committee charter.

Nominating Governance and Community AffairsCorporate Governance Committee

Our Nominating Governance and Community AffairsCorporate Governance Committee consists of Mrs. FristMr. Wilt (Committee Chair), Mr. Bottorff, Mr. Green, Ms. JennePhillips and Mr. Smith. Mrs. Frist will not be standing for re-election atPolley. Ms. Gurganious began serving on the Annual MeetingNominating and Corporate Governance Committee upon being appointed to the Board currently expects that Mr. Wilt will be appointed as the chair of the Nominating, Governance and Community Affairs Committee, subject to his election as a director at the Annual Meeting.on January 14, 2021. Our Nominating Governance and Community AffairsCorporate Governance Committee charter requires that our Nominating Governance and Community AffairsCorporate Governance Committee be comprised entirely of independent directors. The committee is responsible for, among other things, identifying and recommending to our Board qualified individuals to become directors; nominating candidates for election to our Board to fill vacancies that occur between annual meetings of shareholders; in collaboration with the Compensation and Human Resources Committee, periodically reviewing the succession plan for the Chief Executive Officer and other executive officers; advising our Board with respect to the roles and composition of committees; overseeing the evaluation of our Board; assisting our Board in establishing and maintaining effective corporate governance practices; annually evaluating our Board and committees and providing recommendations to help them function more effectively; and establishing and overseeing a compliance risk program that enables the Company to manage compliance risks related to regulatory and internal and external oversight such as the Community Reinvestment Act, fair lending and similar consumer regulations.oversight.

Our Board has determined that each member of our Nominating Governance and Community AffairsCorporate Governance Committee meets the requirements for independence under the rules and regulations of NASDAQ and the SEC.

11

Our Community Affairs Committee consists of Ms. Jenne (Committee Chair), Mr. Cunningham, Mr. Smith, Mr. Turner and Ms. Phillips, all of whom are independent directors. Ms. Gurganious began serving on the Community Affairs Committee upon being appointed to the Board on January 14, 2021. The purposes of the Community Affairs Committee are to ensure that the Company embraces its Mission, Vision and Values, to oversee the Company’s local involvement and leadership in the communities where the Company operates, including matters related to employee engagement, community development, philanthropy, government affairs, reputation management, and diversity and inclusion, and to oversee the Company’s Community Reinvestment Act (“CRA”) Program and Fair Lending Compliance Program.

Our Credit Committee consists of Messrs. Turner (Committee Chair), Bentz, Bottorff, Cunningham, Green and Smith. The charter of our Credit Committee provides that a majority of the members of the committee must be independent. The Credit Committee is responsible for, among other things, monitoring the management of our assets, with a primary focus on loans, other real estate owned, and other customer-related assets; reviewing and monitoring compliance with our Loan and Credit Administration Policy; ensuring review of each criticized and classified loan; reviewing charge-offs and recoveries; monitoring exceptions to loan policies, collateral and financial statements; ensuring that extensions of credit to directors, executive officers and their affiliates are in compliance with law and reviewing loans subject to Regulation O, and, to the extent required by Regulation O and where appropriate, recommending approval of such loans by the full Board; and reviewing progress with respect to management’s goals for improvements in credit quality.

Our Risk Committee consists of Messrs. Polley (Committee Chair), Cunningham and Turner. The charter of our Risk Committee provides that a majority of the members of the committee must be independent. This committee is responsible for, among other things, assisting our Board in its oversight of our enterprise risk management governance and processes and for reviewing and approving the risk parameters to be used by management in the operation of the Company. Additionally, its roles include capital management; providing oversight of asset liability management processes; reviewing the strategic plan and budget before their presentation to the full Board; reviewing our insurance risk management program; ensuring that our internal policies, procedures and guidelines are appropriate to manage risk; monitoring interest rate risk management; and approving our asset/liability and investment policies.

2020 Committee Reassignments and Combining of Audit and Risk Committees

Upon the election of the director nominees at the 2020 Annual Meeting, our Board expects to approveapproved the consolidation of our Audit Committee with our Risk Committee. The newly consolidated Audit and Risk Committee will havehas all of the same responsibilities as were previously assigned to each of the respective committees. Further, all members of the newly consolidated Audit and Risk Committee will bewere required to be independent pursuant to the new Audit and Risk Committee charter, SOX and the rules and regulations of NASDAQ and the SEC. Subject to the election of the director nominees at the Annual Meeting, theThe Board expects to appointappointed Mr. Polley to chair our Audit and Risk Committee and Messrs. Bentz, Flynn and Green will serveserved as members of the Audit and Risk Committee.

Further, subjectAdditionally, the Nominating, Governance and Community Affairs Committee was split into two committees – the Nominating and Corporate Governance Committee and the Community Affairs Committee. The Board appointed Mr. Wilt to the electionchair our Nominating and Corporate Governance Committee and Mr. Bottorff, Ms. Phillips and Mr. Polley served as members of the director nominees atNominating and Corporate Governance Committee. The Board appointed Ms. Jenne to chair our newly created Community Affairs Committee and Mr. Cunningham, Ms. Phillips, Mr. Smith and Mr. Turner served as members of the Annual Meeting,Community Affairs Committee.

Further, the Board expects to appointappointed Mr. Wilt to serve as the chair of our Nominating Governance and Community AffairsCorporate Governance Committee and Mr. Flynn to serve as the chair of our Compensation and Human Resources Committee. The Board also approved the following committee reassignments: Mr. Bottorff was reassigned from the Credit Committee to serve on the Compensation and Human Resources Committee; Mr. Green was reassigned from the Nominating, Governance and Community Affairs Committee to serve on the Credit Committee.

Board and Committee Self-Evaluations

The Board conducts annual self-evaluations and completes questionnaires to assess the qualifications, attributes, skills and experience represented on the Board and to determine whether the Board and its committees are functioning effectively. The Nominating Governance and Community AffairsCorporate Governance Committee oversees this annual review process and, through its Chair, discusses the input with the full Board. In addition, each committee reviews annually the qualifications and effectiveness of that committee and its members. Each year the Board also reviews the Company’s governance documents and modifies them as appropriate. These documents include the charters for each Board committee, our Corporate Governance Guidelines, our Code of Ethics and Conflicts of Interest Policy and other key policies and practices.

The Board and each of the Board committees will continue to monitor corporate governance developments and will continue to evaluate committee charters, duties and responsibilities under our Corporate Governance Guidelines and Code of Ethics and Conflicts of Interest Policy with the intention of maintaining full compliance with all applicable corporate governance requirements.

Board LeadershipLeadership Structure

Our Corporate Governance Guidelines provide for separation of the roles of Chief Executive Officer and Chairman of our Board, a structure which our Board has determined is in the best interests of our shareholders at this time. Mr. Bottorff serves as Chairman of the Board, and Mr. Schools serves as our President and Chief Executive Officer. Mr. Schools also serves as Chief Executive Officer and President of CapStar Bank and as a member of the Bank’s Board.

12

The Board has determined that our bifurcated leadership structure is appropriate for the Company and our shareholders because it (i) enables Mr. Schools to focus directly upon identifying and developing corporate priorities, executing our business plan and providing daily leadership while concurrently ensuring that Mr. Schools and his intimate knowledge of our Company and of the banking industry generally remain as an invaluable resource to our Board and (ii) assists Mr. Bottorff in fulfilling his duties of overseeing the implementation of our strategic initiatives, facilitating the flow of information between the Board and management and fostering executive officer accountability.

Role of the Board in Risk Oversight

The Board has an active role, as a whole and at the committee level, in the Company’s risk oversight process. The Board and its committees receive regular reports from members of senior management on areas of material risk to the Company, including operational, financial, legal, regulatory, strategic and reputational risks. At the committee level, (i) the Audit and Risk Committee oversees the management of accounting, financial and legal risks;risks as well as helping our Board execute its risk management objectives by overseeing an enterprise-wide approach to risk management; (ii) the Compensation and Human Resources Committee oversees the management of risks relating to the Company’s executive compensation program as well as compensation matters involving all employees and the Company’s directors; (iii) the Nominating Governance and Community AffairsCorporate Governance Committee manages risks associated with the independence of the members of the Board and potential conflicts of interest and certain regulatory risks; (iv) the Credit Committee manages risks associated with the Company’s credit risk management; and (v) our Risk Committee is specifically tasked with helping our Board execute its risk management objectives by overseeing an enterprise-wide approach to risk management, which is structured to achieve our strategic objectives, improve our long-term performance and support growth in shareholder value.value; and (v) the Community Affairs Committee oversees the Company’s risks associated with the Company’s Community Reinvestment Act (“CRA”) Program and the Fair Lending Compliance Program.

Although each committee is directly responsible for evaluating certain enumerated risks and overseeing the management of such risks, the entire Board is generally responsible for and is regularly informed through committee reports about such risks and any corresponding remediation efforts designed to mitigate such risks. In addition, appropriate committees of the Board receive reports from senior management within the organization to enable the committees to understand risk identification, risk management and risk mitigation strategies. When a committee receives such a report, the Chair of the relevant committee reports on the discussion to the full Board during the committee reports portion of the next Board’Board meeting. This enables the Board and its committees to coordinate the risk oversight role.

Service Limitations on Other Boards of Directors

Our Corporate Governance Guidelines require that directors should not serve on more than four other boards of public companies (or private, not-for-profit or service organization boards that are deemed by the Board to be equivalent) in addition to our Board. The Nominating Governance and Community AffairsCorporate Governance Committee may, in its discretion, grant exceptions to this limit on a case-by-case basis. None of our directors serve on more than four other boards.

Overview. Pursuant to its charter, the Nominating Governance and Community AffairsCorporate Governance Committee is responsible for the process relating to director nominations, including identifying, reviewing and selecting individuals who may be nominated for election to the Board. The Nominating Governance and Community AffairsCorporate Governance Committee considers nominees to serve as directors of the Company and recommends such persons to the Board. The Nominating Governance and Community AffairsCorporate Governance Committee also considers director candidates recommended by shareholders in accordance with the Company Bylaws and provides a process for receipt and consideration of any such recommendations. On October 24, 2019, our Board approved an amendment and restatement of the Company’s Bylaws that, among other things, expanded the scope of disclosures required of a shareholder to bring a nomination to our Board before a shareholder meeting. This increased disclosure requirement allows our Nominating Governance

and Community AffairsCorporate Governance Committee to better assess the qualifications of director nominees and to ensure that nominees are and will remain in compliance with all laws applicable to the Company’s directors. In approving candidates for election as director, the Nominating Governance and Community AffairsCorporate Governance Committee also seeks to ensure that the Board and its committees will satisfy all applicable requirements of the federal securities laws and the corporate governance requirements for NASDAQ-listed issuers.

Committee Selection Process. The Nominating Governance and Community AffairsCorporate Governance Committee regularly assesses the mix of experience, skills, diversity and industries currently represented on our Board, whether any vacancies on the Board are expected due to retirement or otherwise, the experience, skills and diversity represented by retiring directors, and additional skills highlighted during the self-assessment process that could improve the overall quality and ability of the Board to carry out its functions.

13

The Nominating Governance and Community AffairsCorporate Governance Committee and the Board do not believe the Company should establish term or age limits for its directors. Although such limits could help ensure that there are fresh ideas and viewpoints available to the Board, they hold the disadvantage of losing the knowledge and contributions of directors who have been able to develop, over a period of time, deep insight into the Company and its operations and, therefore, provide an increasing contribution to the Board as a whole. As an alternative to term or age limits, the Nominating Governance and Community AffairsCorporate Governance Committee reviews each director’s continuation on the Board every year. This review includes the analysis of the Nominating Governance and Community AffairsCorporate Governance Committee regarding each director’s independence and whether any director has had a significant change in his or her business or professional circumstances during the past year.

Prior to completing its recommendation to the Board of nominees for election, the Nominating Governance and Community AffairsCorporate Governance Committee requires each potential candidate to complete a director’s and executive officer’s questionnaire and a report on all transactions between the candidate and the Company, its directors, officers and related parties. The Nominating, Governance and Community AffairsCorporate Governance Committee will also consider such other relevant factors as it deems appropriate. After completing this evaluation, the Nominating Governance and Community AffairsCorporate Governance Committee will make a recommendation to the Board of the persons who should be nominated, and the Board will then determine the nominees after considering the recommendations of the Committee.